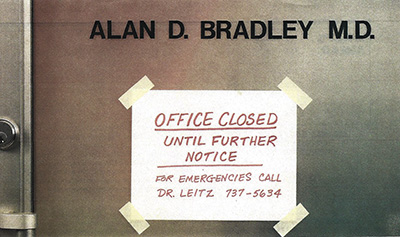

“Twenty-five percent of 20-year-olds will have to take a disability-related leave before reaching retirement age” according to Guardian. Physicians are especially at risk for disabling accidents because of their unique relationship with malpractice carriers, hospitals, patients, referring physicians and their employer. Yet a disabling injury could occur anytime, anywhere, both on the job and off.

What happens to your salary if you are disabled? What would become of your ownership arrangement with your employer? What income could you and your family expect to receive from your disability insurance contracts?

These questions lead you to understand how critical the definition of disability is. Must you be confined to a wheelchair in order to collect disability benefits? Must you remain hospitalized? For how long must you remain incapacitated before disability benefits are paid? What if your disability is partial, permitting you to perform SOME of your duties?

The physician’s largest source of disability income is likely to be his/her disability insurance. Therefore, it is important to fully understand the contractual terms of your disability insurance contracts. Unfortunately, even many insurance professionals don’t really comprehend the provisions of the policies they have sold. Terms like “own occupation protection”, the distinction between partial and residual coverage, the effect of indexing, and cost of living riders are routinely misunderstood. Not all disability insurance contracts are alike. Do you know what’s in yours? Do you know what to look for?

High Limit Disability Income Coverage

for Physicians and Surgeons

Here is a quick example:

An orthopedic surgeon with $750,000 of income needs additional DI protection on top of their existing $20,000 of individual and group disability.

We can help you layer an additional $45,000 per month of High Limit DI on top of the existing plans. The maximum benefits available are up to $150,000 per month not to exceed 65% of current income.

- $45,000 per month of new benefit

- Benefits to age 65, 67 or 70

- Own Occupation – definition of total disability

- 90 day elimination period

- Lump Sum options available

Clients of James D. Yurman are entitled to receive a no-cost, no-obligation written analysis of their CURRENT disability insurance contracts. This service will give you the peace of mind of knowing more fully the kind of coverage you already have and to clarify if you have the OLD TYPE (benefits to age 65) or the NEW TYPE (lifetime benefits) of disability insurance contract.

Contact Jim Yurman:

8500 Station Street – Suite 300G

Mentor, OH 44060

Office Phone: (440) 358 – 0605

MYREPCHAT Text: (216) 232 – 3416

E-mail: jyurman@grandriverllc.com

Other contact information:

VALMARK SECURITIES, INC.

130 Springside Drive, Suite 300

Akron, OH 44333-2431

(800) 765 – 5201