- Stocks have been trading near historic highs for months. A pullback was all but guaranteed and is a very normal part of market cycles. What gave investors a fright was the speed at which the pullback occurred.

- Emotion is in the driver’s seat. The opposing emotions of fear and greed are putting stocks all over the map. Savvy investors are watching and waiting for opportunities to snap up bargains.

- Fears about China are probably overrated. Slumping exports, currency devaluations, and shrinking smartphone sales have triggered dire warnings about the state of the Chinese economy. Let’s put China in perspective: Exports to China are worth 0.7% of U.S. GDP. Even if China slips into a recession, it may not be the end of the world.[2] Some U.S. companies that sell a lot of goods in China may feel the pinch, but most of U.S. growth is driven by what we consume at home.

How long will the correction last? No one knows for sure, but it’s probably not a repeat of 2008 again. The financial crisis was driven by fundamental factors like a housing market crash and the ensuing mortgage meltdown. We can say that fundamentals for U.S. stocks remain positive. Here’s what we’re looking at:

- The labor market has gained jobs steadily over the last 65 months.[3] Though wage growth is still tepid, there is unambiguous improvement in this major driver of economic growth.

- Consumer confidence spiked to its highest level in seven months in August, showing that Americans are upbeat about the economy.[4]

- The housing market is picking up steam, indicating that all those new jobs are giving many Americans the confidence they need to buy a house.[5]

- The selloff may delay a Federal Reserve interest rate hike. Investors are uncertain about when and how the Federal Reserve will raise interest rates. People worried that the end of quantitative easing would spell disaster for stocks, but the S&P 500 still gained 9.5% between the start of tapering and the end of tapering.[6] While the Wall Street consensus was for a September rate hike, recent market events may give the Fed more pause for thought.

Keep Calm and Carry On

Now, all of this is to say: Keep cool, keep calm, and focus on your own goals. While it’s stressful to see portfolio values swing so wildly, the data behind the recent volatility doesn’t indicate any fundamental reasons to worry. Go outside, take a walk, play some golf. We’re keeping a very close eye on what’s happening in markets and will be in touch as conditions warrant.

Click here to view full newsletter with reference articles, tax tips, golf tips, recipe of the week and more!

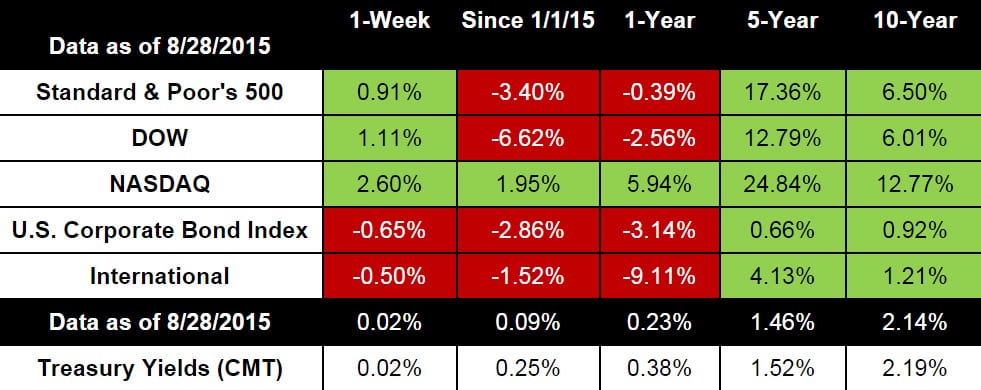

Notes on featured image: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized. Sources: Yahoo! Finance and Treasury.gov. International performance is represented by the MSCI EAFE Index. Corporate bond performance is represented by the DJCBP. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.