Markets ended another week down after mixed economic data, lower oil prices, and a strengthening dollar made investors nervous ahead of the next Federal Reserve meeting. For the week, the S&P 500 lost 0.86%, the Dow fell 0.60%, and the NASDAQ dropped 1.13%[1]

The dollar became the focus of a lot of speculation last week when it reached multi-year highs against a weakened euro.[2] The return of “King Dollar” worries many analysts because it means that foreigners can afford to buy fewer U.S. goods, depressing demand for many U.S. firms and cutting into profits. On the other hand, a stronger dollar makes imports cheaper and increases the buying power of U.S. consumers, which has been historically good for the economy.[3]

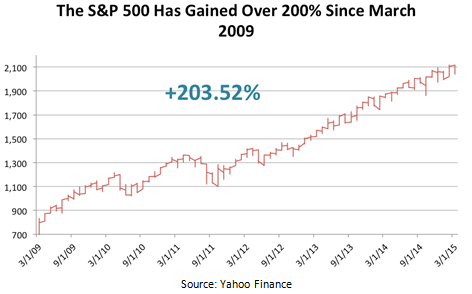

Speaking of history, Monday, March 9, 2015 marked the sixth anniversary of the current bull market, which began on March 9, 2009. Though markets have been turbulent in recent weeks, let’s take a moment to think about how far we’ve come since the dark days of the financial crisis. Since the bottom of the stock market, the S&P 500 has gained 203.52%, surpassing previous market highs along the way.[4]

We’ve seen major improvements in economic fundamentals as well. Since peak unemployment of 10.0% in October 2009, the unemployment rate has dropped nearly in half to 5.5% as of last month. With millions of Americans back to work and contributing to the economy, economic growth has also made significant gains. From the fourth quarter of 2008, when Real Gross Domestic Product decreased at an annual rate of 6.3%, the economy has improved, reaching 5.0% annualized growth in the third quarter of 2014 and 2.2% (estimated) growth in the fourth quarter.[5,6]

Bottom line: Economic fundamentals have come a long way and there are plenty of factors that support continued equity growth. That’s not to say that there aren’t headwinds that may affect market performance in the future. The Federal debt debate is rearing its ugly head again in Washington as lawmakers square off about the Treasury debt ceiling, which will be breached this week.[7] We’re also approaching the end of the first quarter and investors will be looking toward corporate earnings releases to see how U.S. companies performed. Markets may remain choppy as investors take stock of current fundamentals and try to predict how policy changes may affect markets.

This week, analysts will be closely watching the Federal Reserve’s two-day policy meeting, which is one of the most important we’ve had since last year. Though we don’t expect the central bank to raise rates this week, investors should know a lot more about the Fed’s plans once the meeting is over.[8]

ECONOMIC CALENDAR:

Monday: Empire State Mfg. Survey, Industrial Production, Housing Market Index, Treasury International Capital

Tuesday: Housing Starts

Wednesday: EIA Petroleum Status Report, FOMC Meeting Announcement, Chair Press Conference, FOMC Forecasts

Thursday: Jobless Claims, Philadelphia Fed Business Outlook Survey

Quote of the week:

“The average person puts only 25% of his energy and ability into his work. The world takes off its hat to those who put in more than 50% of their capacity, and stands on its head for those few and far between souls who devote 100%.” – Andrew Carnegie

HEADLINES:

- Retail sales fall in February. U.S. retail sales dropped for a third straight month, surprising many analysts who counted on job growth and cheap gasoline to boost sales. Harsh winter weather may be keeping shoppers at home, depressing retail spending numbers.[9]

- Weekly jobless claims drop more than expected. The number of Americans claiming new unemployment benefits fell last week, erasing much of the previous weeks’ increases. Economists suspect seasonal factors are at play and that the labor market continues to improve.[10]

- Consumer sentiment slides for fourth straight month. American consumers ratcheted back their optimism about the U.S. economy in early March, though temporary factors may be affecting data. While affluent Americans remain confident about the future, lower and middle-income consumers are worried about their prospects.[11]

- Weekly mortgage applications drop. A sharp increase in mortgage rates last week caused a corresponding drop in mortgage applications. Both mortgage applications and refinancing activity fell as buyers responded to higher rates.[12]

Click here to view full newsletter with reference articles, tax tips, golf tips, recipe of the week and more!

Notes on featured image: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized. Sources: Yahoo! Finance and Treasury.gov. International performance is represented by the MSCI EAFE Index. Corporate bond performance is represented by the DJCBP. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.